41 yield to maturity of a coupon bond formula

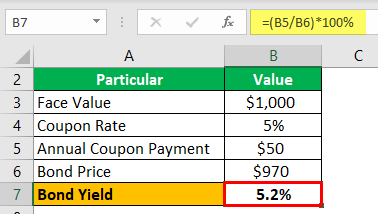

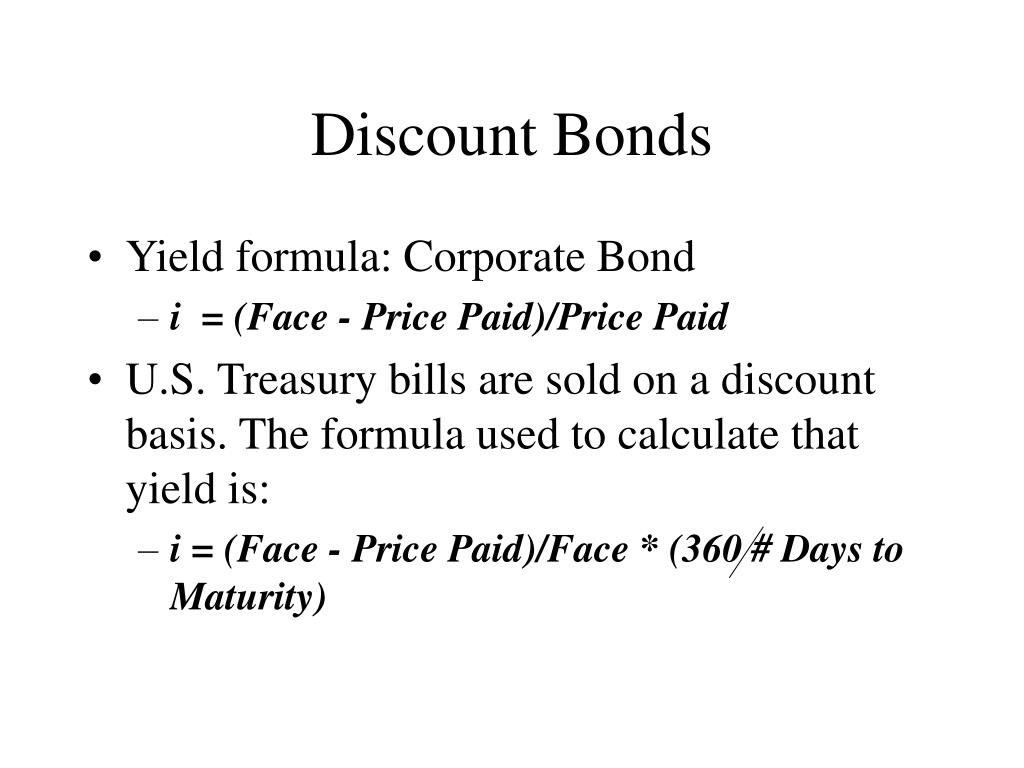

Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... Coupon Bond Formula | Examples with Excel Template Therefore, the current market price of each coupon bond is $932, which means it is currently traded at discount (current market price lower than par value). Coupon Bond Formula - Example #2. Let us take the same example mentioned above. In this case, the coupon rate is 5% but to be paid semi-annually, while the yield to maturity is currently ...

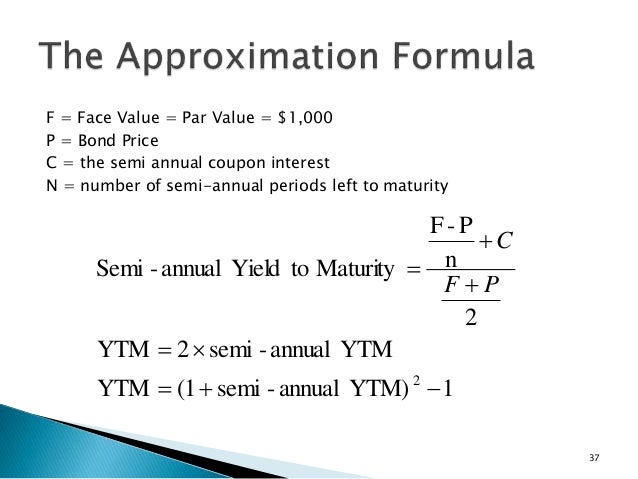

Bond Yield to Maturity (YTM) Calculator - DQYDJ Coupon Frequency: 2x a Year 100 + ( ( 1000 - 920 ) / 10) / ( 1000 + 920 ) / 2 = 100 + 8 / 960 = 11.25% What's the Exact Yield to Maturity Formula? If you've already tested the calculator, you know the actual yield to maturity on our bond is 11.359%. How did we find that answer?

Yield to maturity of a coupon bond formula

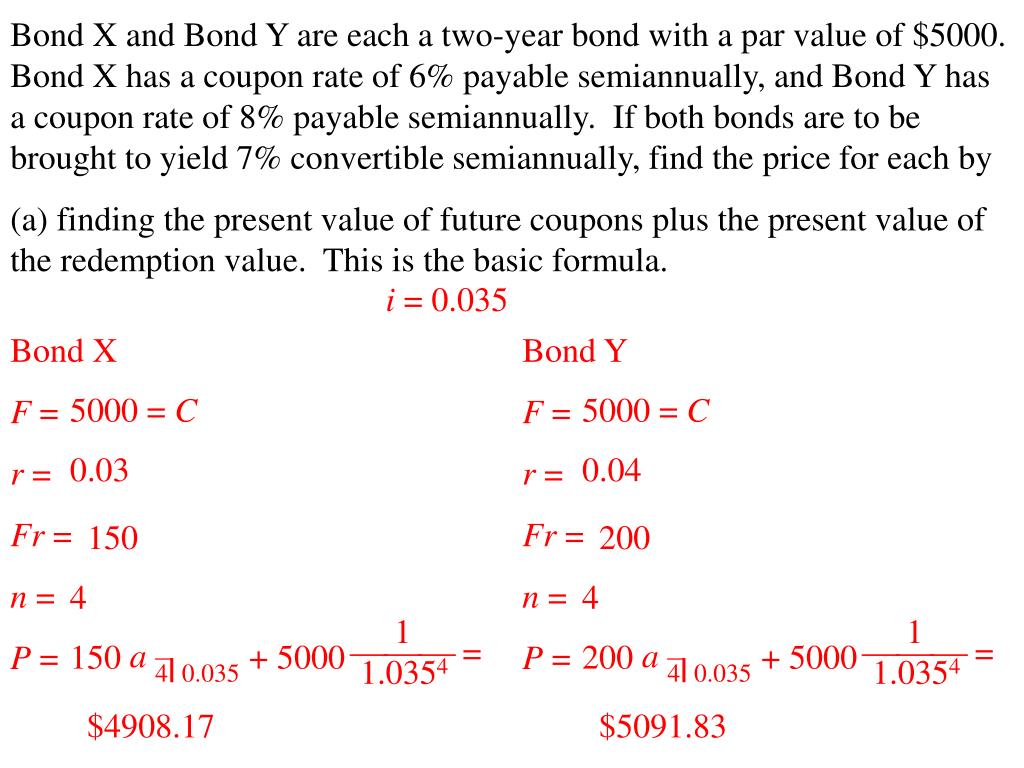

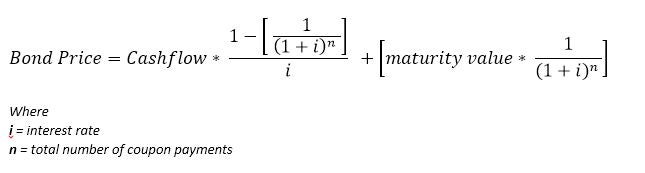

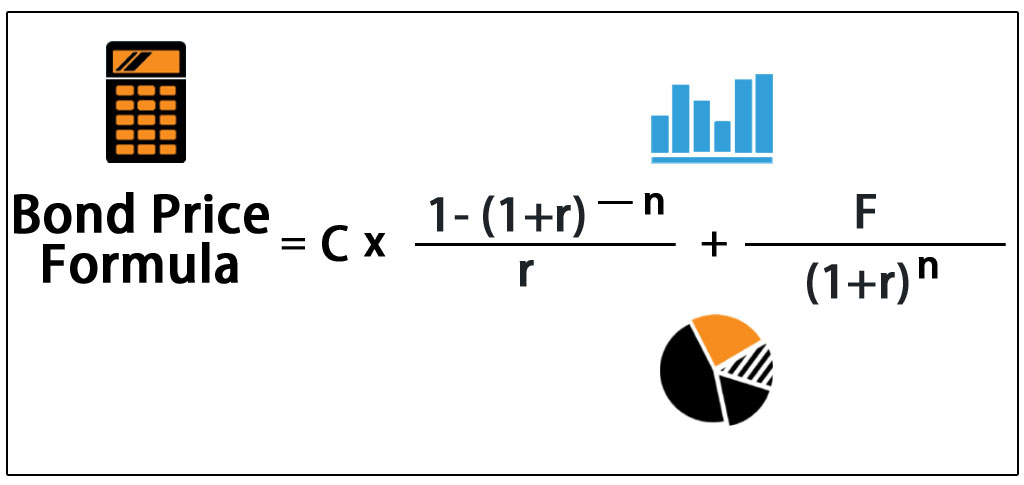

Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is basically the ... Yield to Maturity (YTM) - Definition, Formula, Calculations Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates etc, Please provide us with an attribution link The formula below calculates the bond's present value. Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments

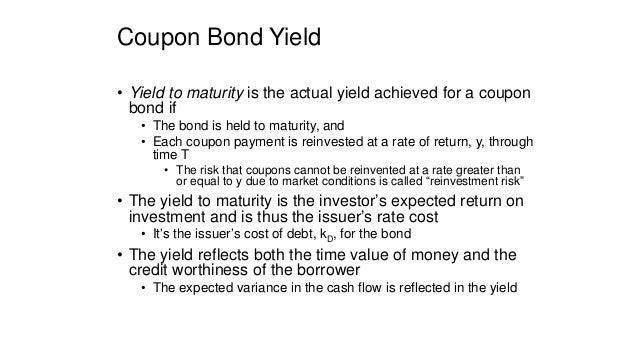

Yield to maturity of a coupon bond formula. Bond Yield Formula | Calculator (Example with Excel Template) YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTM. Mathematically, the formula for bond price using YTM is represented as, Bond Price = ∑ [Cash flowt / (1+YTM)t] Where t: No. of Years to Maturity How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently... Bond Yield: Formula and Calculator [Excel Template] The coupon rate, also known as the "nominal yield," determines the annual coupon payment owed to a bondholder by the issuer until maturity. The coupon, i.e. the annual interest payment, equals the coupon rate multiplied by the bond's par value. Bond Coupon Rate Formula Yield to Maturity (YTM): Formula and Excel Calculator If the YTM = Coupon Rate and Current Yield → The bond is said to be "trading at par". Drawbacks to Yield to Maturity (YTM) The most noteworthy drawback to the yield to maturity (YTM) measure is that YTM does NOT account for a bond's reinvestment risk.

Yield to Maturity (YTM) - Meaning, Formula & Calculation Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM. Where to find yield to maturity? How do you calculate the yield to maturity of a bond? Yield To Maturity Formula Coupon = Multiple interests received during the investment horizon. These are reinvested back at a constant rate. Face value = The price of the bond set by the issuer. YTM = the discount rate at which all the present value of bond future cash flows equals its ... 1. What is the market yield-to-maturity (YTM) of a 7% Coupon Bond that ... Current market interest rate (YTM) for such a bond is 8.0% (use semi-annual discounting) 3.What is the market yield-to-maturity (YTM) of a Zero Coupon Bond that pays $1,000 face at maturity in10 years from now? The current market price of this bond is $614. (use annual discounting or approximate YTM formula) Current Yield vs. Yield to Maturity - Investopedia Yield to Maturity of Bonds . The YTM formula is a more complicated calculation that renders the total amount of return generated by a bond ... How to Calculate Yield to Maturity of a Zero-Coupon Bond.

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Solved If the bond is currently listed as 950 Compute the | Chegg.com The bond has five years left until it matures. The current market interest rate equals 5%. Compute the bond's market value; Question: If the bond is currently listed as 950 Compute the yield to maturity for the bonds holder? 1. A $1,000 unit bond has a coupon rate of 5%. The bond has five years left until it matures. The current market ... Bond Yield Formula | Step by Step Calculation & Examples Bond Yield Formula = Annual Coupon Payment / Bond Price. Bond Prices and Bond Yield have an inverse relationship; When bond price increases, bond yield decreases. ... frequency of payment, and amount value at the time of maturity. Step 1: Calculation of the coupon payment annual payment. Annual Coupon Payment = Face Value * Coupon Rate =$1300*6 ... Yield to Maturity - Approximate Formula (with Calculator) Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be After solving this equation, the estimated yield to maturity is 11.25%. Example of YTM with PV of a Bond Using the prior example, the estimated yield to maturity is 11.25%.

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Yield to Maturity Formula & Examples | How to Calculate YTM - Video ... First, for all the problems, calculate the coupon or interest payment each year by finding 6.5% of $150. $150 (0.065) = $9.75. Then, use the YTM formula for all situations below with C = 9.75, F =...

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where

Chapter 6 Bond Lecture_slides 1-23_stu.pdf - Chapter 6... View Chapter 6 Bond Lecture_slides 1-23_stu.pdf from BUAD MISC at California State University, Fullerton. Chapter 6 Bonds - Part I • Objectives - Bond terminology - Bond valuation - Yield to

PPT - Example 6.1 illustrates the calculation of a yield rate for a zero coupon bond. PowerPoint ...

Yield to Maturity (YTM) Definition - investopedia.com The bond is currently priced at a discount of $95.92, matures in 30 months, and pays a semi-annual coupon of 5%. Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92...

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate Coupon RateA coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

XPLAIND.com | Definitions, Explanations & Examples - 05/2022 Memorial Day Weekend 2022 Ready! The Big Sale Is Waiting For You!

Compute yield to maturity for a bond with coupons when price is ... There might be a closed-form method that is more efficient, but in practice, bond market calculations have a lot of irregularities when compared to the pricing formula given above. As an addendum, if you have access to two functions, you can use Newton-Raphson. A function to calculate price from yield.

Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments

Zero Coupon Bond Formula : Accounts and Finance Formulas / Its yield results from the difference ...

Yield to Maturity (YTM) - Definition, Formula, Calculations Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates etc, Please provide us with an attribution link The formula below calculates the bond's present value.

Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is basically the ...

Post a Comment for "41 yield to maturity of a coupon bond formula"