44 define zero coupon bond

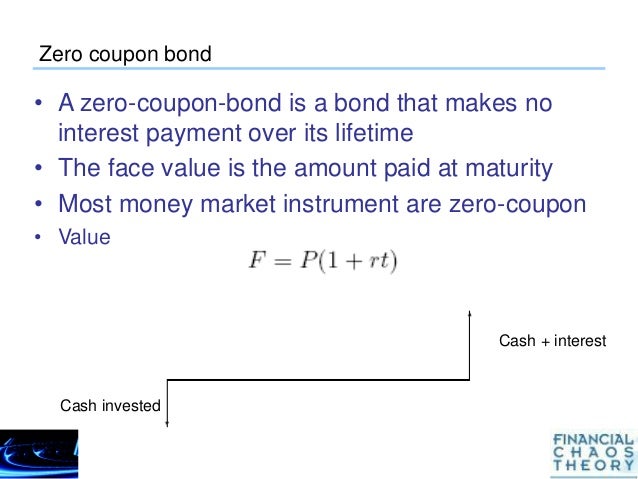

Zero-coupon bond | definition of zero-coupon bond by Medical dictionary zero [ze´ro] 1. the absence of all quantity or magnitude; naught. 2. the point on a thermometer scale at which the graduations begin. The zero of the Celsius (centigrade) scale is the ice point; on the Fahrenheit scale it is 32 degrees below the ice point. absolute zero the lowest possible temperature, designated 0 on the Kelvin or Rankine scale; the ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs ...

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Define zero coupon bond

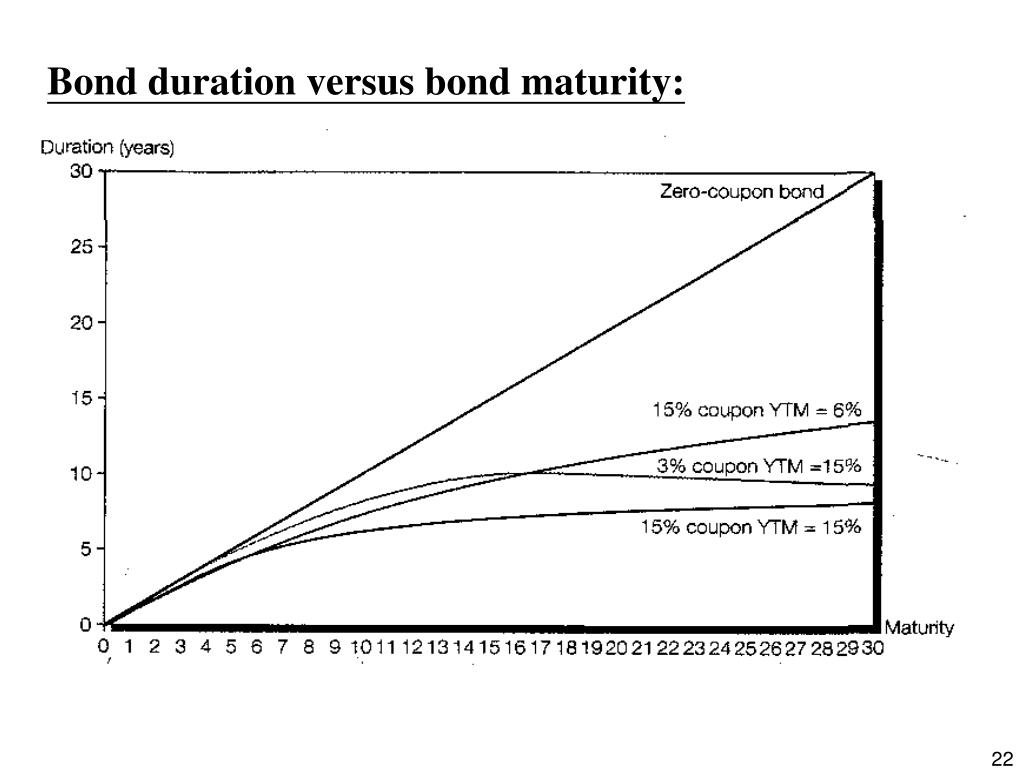

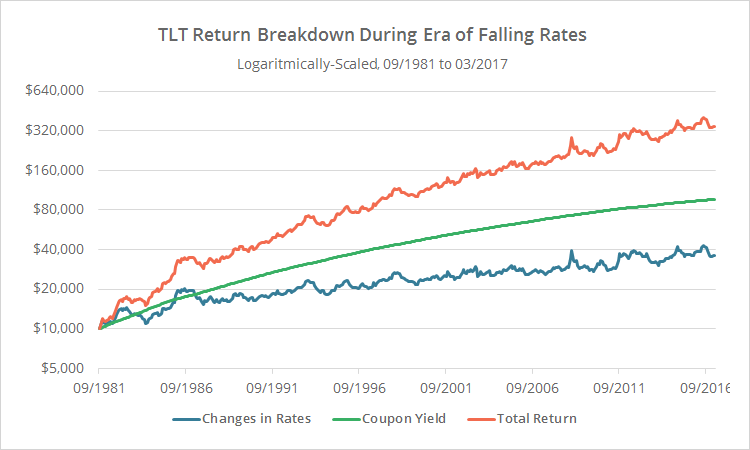

Zero-Coupon Bonds - Accounting Hub Definition. A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning. Zero Coupon Bonds financial definition of Zero Coupon Bonds Zero-Coupon Bond A bond that pays no interest. It is sold at a discount from par and matures at par. These are fairly illiquid investments because they do not benefit from changes in interest rates. However, they tend to be low- risk. Zero-coupon bonds fluctuate in price, sometimes dramatically, with changes in interest rates. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.

Define zero coupon bond. Zero-Coupon Bond: Formula and Excel Calculator Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. If Price > 100 "Premium" (Trading Above Par) If Price = 100 "Par" (Trading at Par Value) If Price < 100 "Discount" (Trading Below Par) Zero-coupon bond financial definition of Zero-coupon bond Zero-Coupon Bond A bond that pays no interest. It is sold at a discount from par and matures at par. These are fairly illiquid investments because they do not benefit from changes in interest rates. However, they tend to be low- risk. Zero-coupon bonds fluctuate in price, sometimes dramatically, with changes in interest rates. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Zero Coupon Bond - Definition - Moneychimp Zero Coupon Bond A bond that sells at a huge discount and pays no interest. What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

Zero coupon bond - definition of zero coupon bond by The Free Dictionary zero coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero-coupon bond What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity. What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... zero coupon bonds definition and meaning | AccountingCoach zero coupon bonds definition A bond without a stated interest rate. Because no interest is paid, the bond will sell for a discount from its maturity value.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

Zero Coupon Bond | Definition, Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ...

Answered: Define Zero-coupon bond. | bartleby Solution for Define Zero-coupon bond. Start your trial now! First week only $4.99! arrow_forward

Zero Coupon Bonds - UWorld Roger CPA Review Zero coupon bonds increase in value every month, but pay no regular interest payments. If you buy a series EE government savings bond, the government will not pay you regular monthly payments, but when you cash it in you will get more than you originally paid for the bond. The interest has been accruing on this bond and you will get both the ...

Learn About Zero Coupon Bond | Chegg.com Zero Coupon Bond Definition. Zero-coupon bonds are long-term investment bonds that offer no periodic interest payments and are sold at a substantial discount compared to the par value. They are also called deep discount bonds or pure discount bonds. The bondholder receives returns in the form of an increase in the value of the investment ...

Post a Comment for "44 define zero coupon bond"