41 coupon rate for treasury bonds

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield …

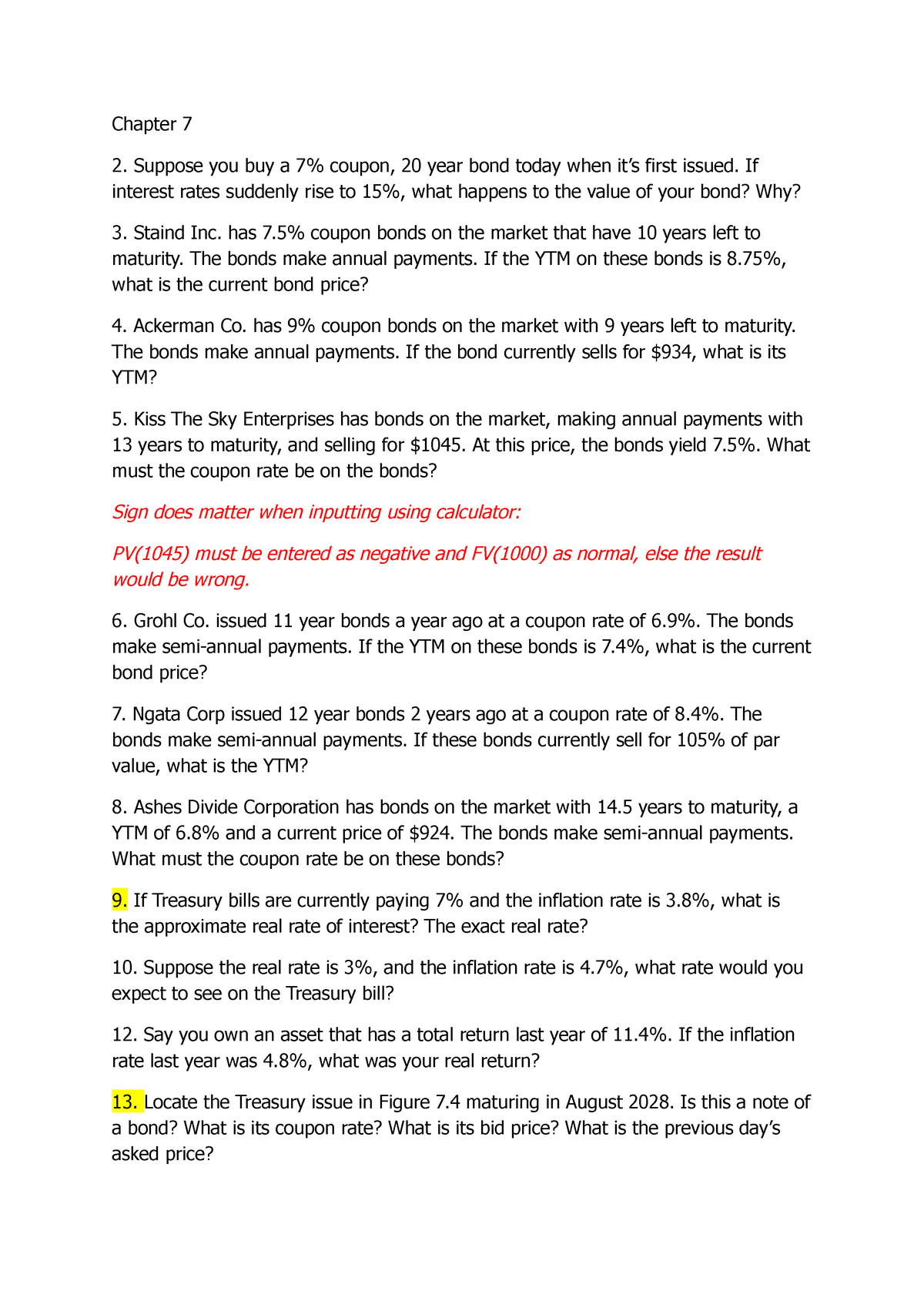

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes Keep in mind that the 9.62% rate is an annualized return, which means for the six months it is in effect the actual return will be 4.81% or $481 on the $10,000 maximum that can be invested. What...

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

Coupon rate for treasury bonds

Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so... How Often do Treasury Bonds Pay Interest? | Fox Business A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the annual coupon ... Treasury's Certified Interest Rates — TreasuryDirect Treasury's Certified Interest Rates include Federal Credit Similar Maturity Rates, the Prompt Payment Rate, and Interest Rates for Various Statutory Purposes. Federal Credit Similar Maturity Rates Prompt Payment Rate Interest Rates for Various Statutory Purposes Monthly Quarterly Semi-Annual Annual Continued Treasury Zero Coupon Spot Rates

Coupon rate for treasury bonds. United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . Government - Continued Treasury Zero Coupon Spot Rates* - Savings Bonds SLGS Rates; IRS Tax Credit Bonds Rates; Treasury's Certified Interest Rates. Federal Credit Similar Maturity Rates. Prompt Payment Act Interest Rate. ... Continued Treasury Zero Coupon Spot Rates* Treasury Spot Rates, Office of Thrift Supervision (OTS) Method; End of Quarter, Percent; Maturity 2012 2013; Years Months I II III IV I II; 0.5: 6: 0.15: Treasury bonds paying an 8% coupon rate with semiannual paym | Quizlet A city government wants to raise $3 million by issuing bonds. By ballot proposition, the bond's coupon interest rate was set at 8% per year with semiannual payments. However, market interest rates have risen to a nominal 9% interest rate. If the bonds mature in 20 years, how much will the city raise from issuing$3M in bonds Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

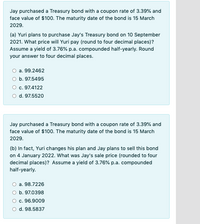

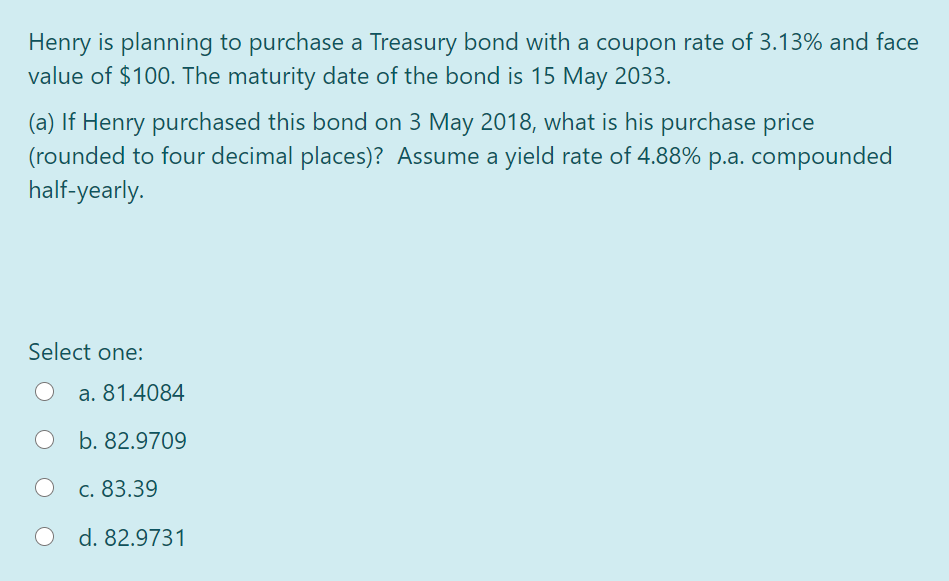

Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Solved Henry is planning to purchase a Treasury bond with a | Chegg.com Assume a yield rate of 3.02% p.a. compounded half-yearly. Henry needs to pay 25.6% on coupon payment; Question: Henry is planning to purchase a Treasury bond with a coupon rate of 2.65% and face value of $100. The maturity date of the bond is 15 March 2033. HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ... Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued.

Understanding Coupon Rate and Yield to Maturity of Bonds In the above example, a Retail Treasury Bond (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. Treasury Bonds | CBK Treasury Bond Results. AUGUST 2022 FXD1-2022-003, FXD2-2019-010 AND FXD1-2021-20 DATED 22-AUG 2022.. Please note that calculators are provided to serve as guides for investors, but all final pricing is determined by the Central Bank. This calculator allows you determine what your payment would be based on the bond's face value, coupon rate ... How to Buy Treasury Bonds: Prices & Options for Beginners Jul 20, 2022 · Treasury bonds (T-Bonds): Known in the investment community as "the long bond," T-bonds generally mature in 20 to 30 years. Treasury notes (T-Notes): These mature within 2 to 10 years.

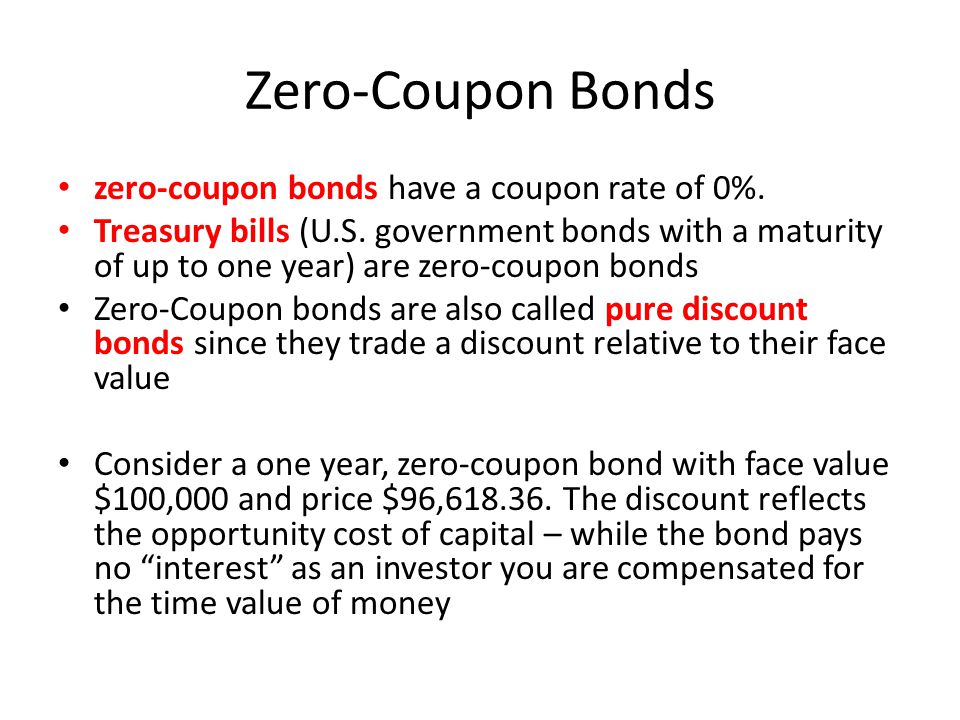

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. Bonds with a longer duration are more sensitive to the impact of interest rate shifts. Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with ...

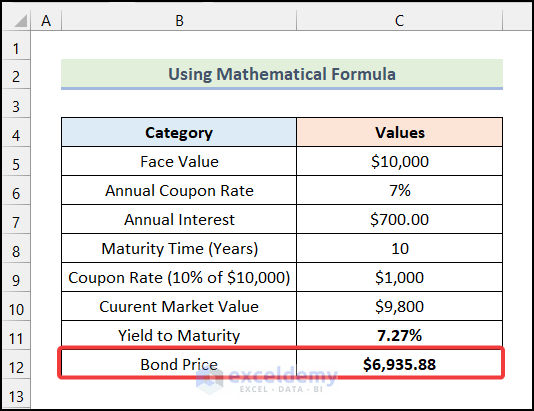

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Why are there different coupon rates of treasury bonds on the ... - Quora Answer (1 of 2): Because they were issued at different times. Suppose you have two Treasury securities maturing in 5 years. One was issued 5 years ago as a 10-year note, the other day as issued 15 years ago as a 20-year bond. Over the last thirty years interest rates have plunged, so the securit...

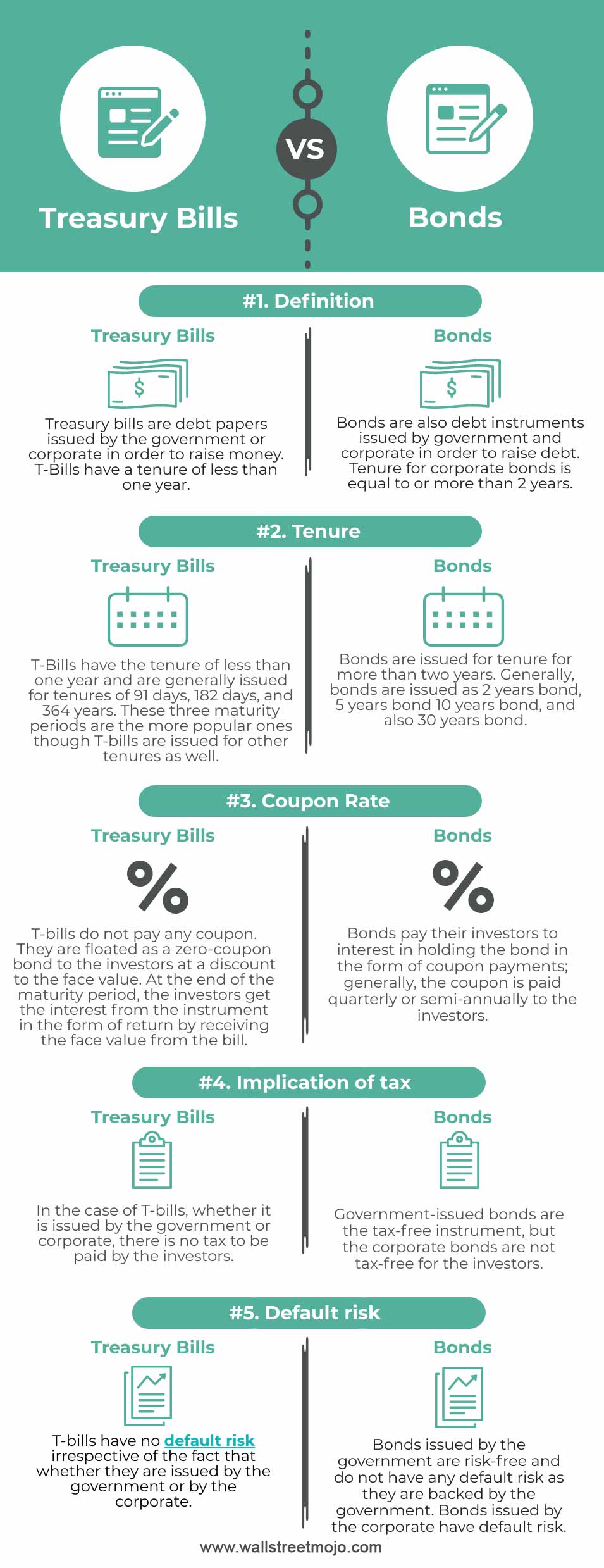

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Interest Rate Statistics | U.S. Department of the Treasury 11.10.2022 · To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

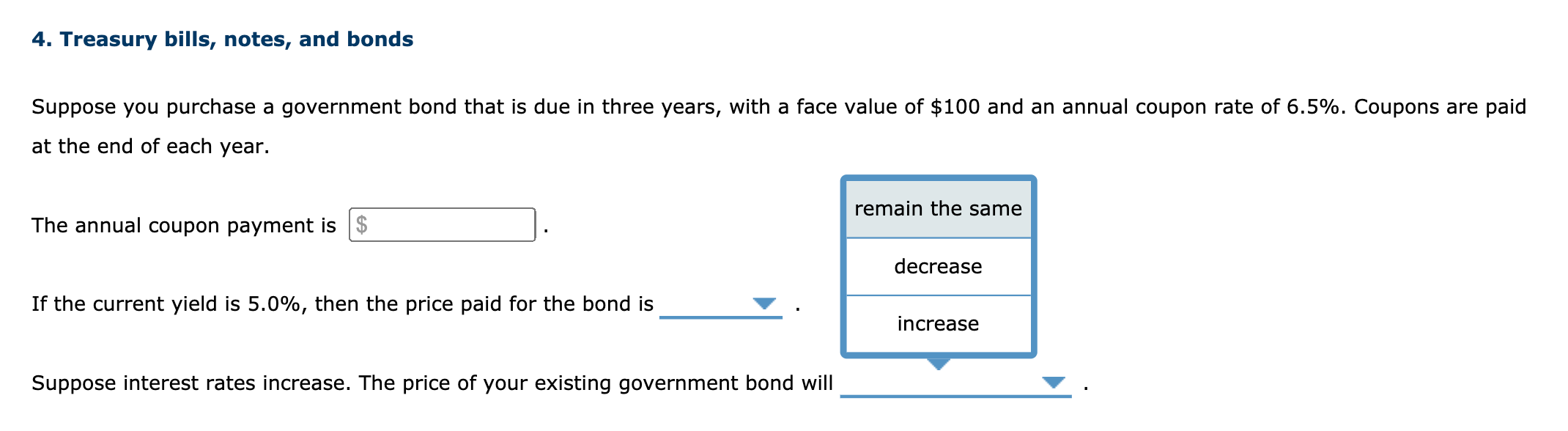

Treasury Coupon Bonds - Economy Watch The most important advantage of treasury coupon bonds is that they let you create a stable source of income during a given year. The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate. [br]

Understanding Pricing and Interest Rates — TreasuryDirect Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

Bond (finance) - Wikipedia The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR).

What Is a Coupon Rate? - Investment Firms Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ...

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Instead, a set percent of the face value of the bond is paid out at periodic intervals. This is known as the coupon rate. 2 For example, a $10,000 T-bond with a 5% coupon will pay out $500...

United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 26 and 52 weeks, each of these approximating a different number of …

US Treasury Series I Savings Bonds Inflation Rate Earnings (May ... 28.4.2022 · US government [treasurydirect.gov] is expected to pay 9.62% on its I-bonds in combined Fixed + Inflation Rate Earnings valid on newly issued Series I Savings Bonds purchased 05/01/22-10/30/22. In laymen's terms: These are safe U.S. treasury securities which adjust their interest rate every 6 months based on the current inflation rate.

How does the U.S. Treasury decide what coupon rate to offer on Treasury ... The Treasury picks the coupon to the nearest 1/8th that prices the bond closest to par. E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia 22.3.2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

How To Buy Treasury Bonds And Buying Strategies To Consider 28.9.2022 · With U.S. Treasury bond yields zooming higher, the interest in buying Treasury bonds has followed suit. Let me show you how to buy Treasury bonds online. I’ll then share some buying strategies to help maximize returns and liquidity. Treasury bonds are risk-free investments if you hold them until maturity. Treasury bonds are issued by the United States federal government to …

Who sets the coupon rate for treasury bonds? : r/bonds - reddit The Federal Reserve sets the coupon rate as the fiscal agent for the Treasury. But there's really no "setting." Whatever is the winning yield at auction, they raise it to the next highest 8th and that becomes the coupon. So if the winning yield is 2.10, the coupon would become 2.125. 2.

Coupon Definition - Investopedia 2.4.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · Though bonds may be issued with variable rates tied to LIBOR, most bonds are issued with a fixed rate, causing the coupon rate and yield to often be different. 1:21 Comparing Yield To Maturity And ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Treasury's Certified Interest Rates — TreasuryDirect Treasury's Certified Interest Rates include Federal Credit Similar Maturity Rates, the Prompt Payment Rate, and Interest Rates for Various Statutory Purposes. Federal Credit Similar Maturity Rates Prompt Payment Rate Interest Rates for Various Statutory Purposes Monthly Quarterly Semi-Annual Annual Continued Treasury Zero Coupon Spot Rates

How Often do Treasury Bonds Pay Interest? | Fox Business A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the annual coupon ...

Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so...

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

/GettyImages-182832748-af3f3d3824034fdaa66ac937fc2d7a40.jpg)

![Solved Problem 6-30 Coupon Rates (LO 2] You find the | Chegg.com](https://media.cheggcdn.com/media/8b2/8b2d21d5-5201-4261-831d-af824a31d07b/phpR0SF2D.png)

Post a Comment for "41 coupon rate for treasury bonds"