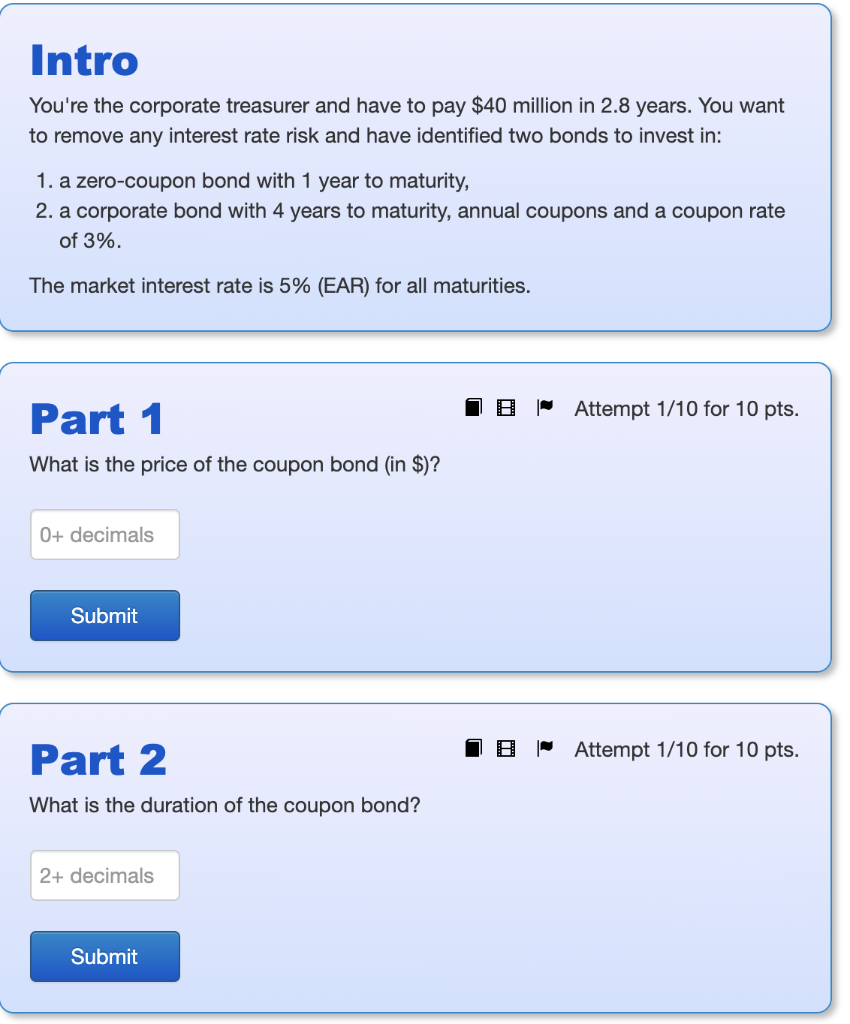

45 coupon vs interest rate

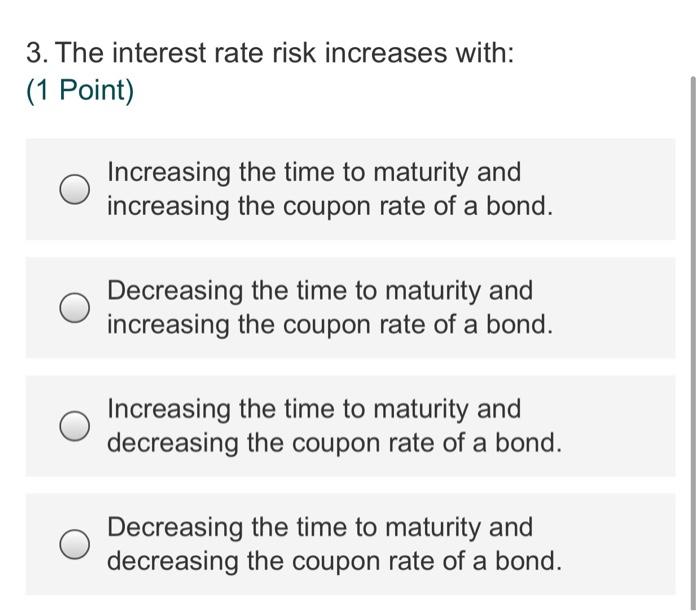

Internal Rate of Return (IRR) Rule: Definition and Example Aug 24, 2022 · Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount ... Difference Between Coupon Rate and Discount Rate Coupon rates are generally affected by the loan fees set by the government.1 Subsequently, on the off chance that the public authority expands the base financing cost to 6%, any previous securities with coupon rates beneath 6% lose esteem. The coupon rate is communicated as a level of its standard capital.

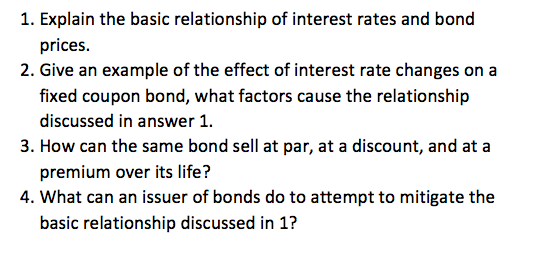

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

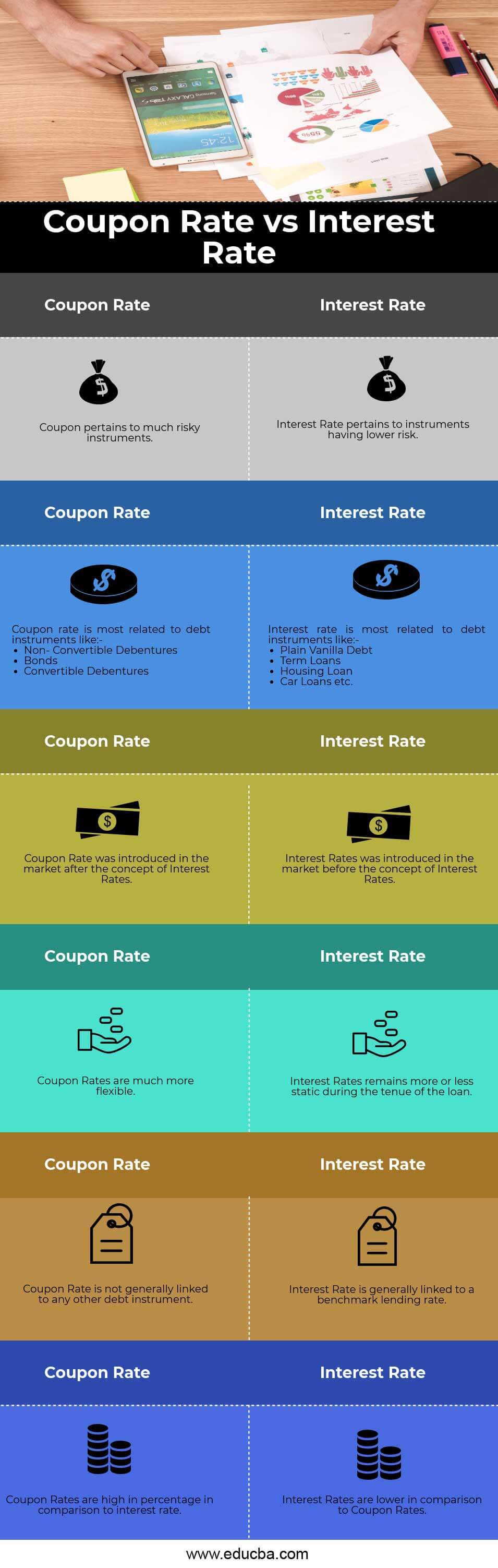

Coupon vs interest rate

Coupon vs. Interest - What's the difference? | Ask Difference Coupon noun. A certificate of interest due, printed at the bottom of transferable bonds (state, railroad, etc.), given for a term of years, designed to be cut off and presented for payment when the interest is due; an interest warrant. ... Coupon noun. the nominal rate of interest on a fixed-interest security 'the stock carries a 10 per cent ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. What Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

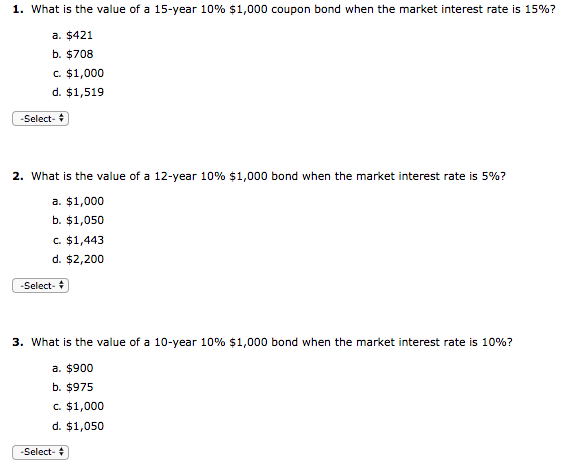

Coupon vs interest rate. What is 'Coupon Rate' - The Economic Times Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the coupon rate is 10 per cent. Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Understanding the Relationship Between Coupon Rates and Duration There is a question regarding duration that I continue to struggle with. Which of the following are true: 1 - Lower coupon bonds are more sensitive to interest rates than high coupon bonds. 2 - There is inverse relationship between bond prices and change in interest rates. 3 - There is a positive relationship between coupon rates and ... Difference Between Coupon Rate and Interest Rate • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender.

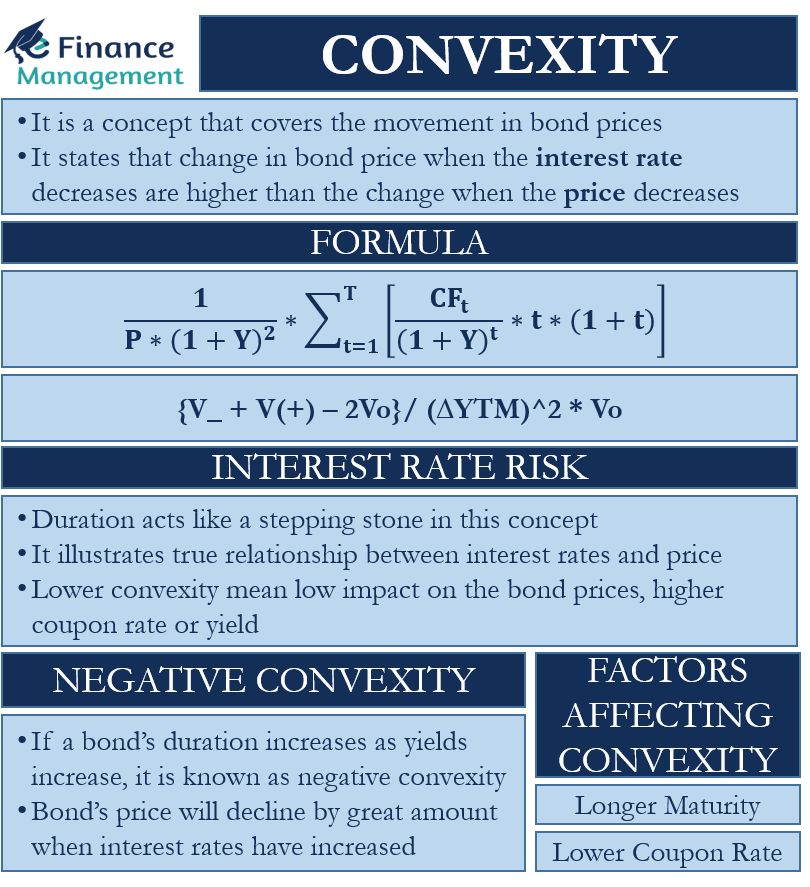

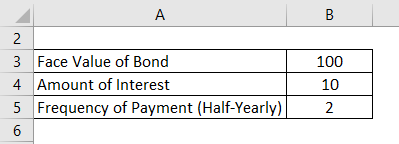

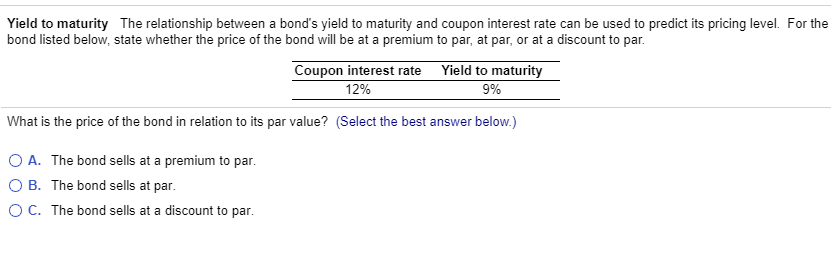

Difference Between Coupon Rate and Required Return The coupon rate is the amount of interest that the buyer of the bond will receive annually. The required return is the percentage of return of bond assuming that the asset is withheld by the investor until the bond matures. Formula Coupon rate = ( Total annual payment/par value of bond) * 100 ... What is difference between coupon rate and interest rate? What is the difference between a coupon rate and an interest rate in a bond? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... Difference Between Coupon Rate and Yield to Maturity The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver. In contrast, Yield to Maturity (YTM ...

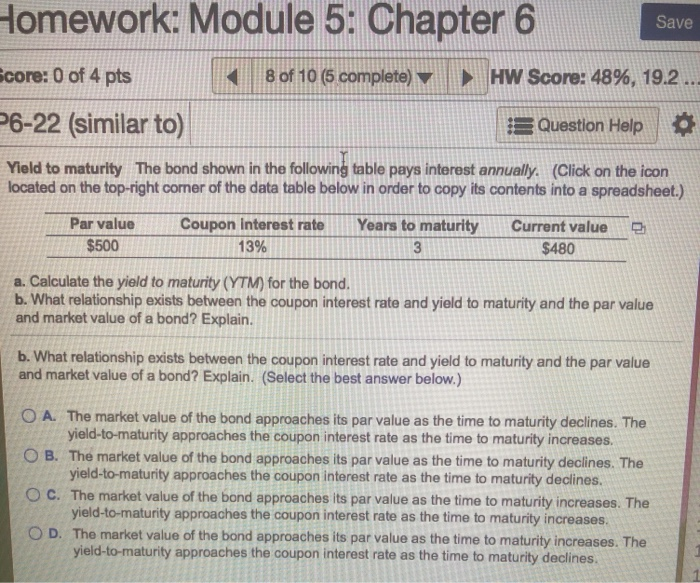

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. ... A single discount rate applies to all as-yet-unearned interest payments ... Mortgage Rates: Compare Today's Rates | Bankrate Sep 20, 2022 · Today's national mortgage rate trends. On Tuesday, September 20, 2022, the current average rate for the benchmark 30-year fixed mortgage is 6.33%, rising 23 basis points compared to this time last ...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Coupon rate definition — AccountingTools What is a Coupon Rate? A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be -. Coupon Rate = 5-Year Treasury Yield + .05%. So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5 ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons.

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Coupon Rate vs. Interest Rate - What's The Difference (With Table) Coupon rates change from time to time as they are more volatile, while interest rates are usually fixed and remain constant since it is decided by the lender alone. The coupon rate is applied on debt instruments like debentures and bonds, while interest rates are used on any types of loans availed from banks, financial institutions, or individuals.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways Coupon rates are the...

Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... Coupon rate refers to the fixed interest payments paid by the bond issuer and will be the same during the life of the bond. On the other hand, market interest rates might rise or fall and...

Coupon Rate vs. Discount Rate - What's The Difference (With Table) A coupon rate can be described as the annual rate of interest that the bond issuer pays to the bondholder on the fixed income security whereas a discount rate can be defined as the rate of interest chosen by the bank, paid to the lender by the borrower and is directly affected by the general economic conditions.

CD Rate and APY: What's the Difference? | Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates,...

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The key differences between Coupon Rate vs. Interest Rate are as follows - The coupon rate is calculated on the face value of the bond , which is being invested. The interest rate is calculated considering the basis of the riskiness of lending the amount to the borrower. The coupon rate is decided by the issuer of the bonds to the purchaser.

Coupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Difference Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on. The coupon rate follows a formula to calculate the rate.

Bond Coupon Interest Rate: How It Affects Price - Investopedia When the prevailing market rate of interest is higher than the coupon rate—say there's a 7% interest rate and a bond coupon rate of just 5%—the price of the bond tends to drop on...

Variable Interest Rate: Definition, Pros & Cons, Vs. Fixed Mar 31, 2021 · Variable Interest Rate: A variable interest rate is an interest rate on a loan or security that fluctuates over time, because it is based on an underlying benchmark interest rate or index that ...

What Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon vs. Interest - What's the difference? | Ask Difference Coupon noun. A certificate of interest due, printed at the bottom of transferable bonds (state, railroad, etc.), given for a term of years, designed to be cut off and presented for payment when the interest is due; an interest warrant. ... Coupon noun. the nominal rate of interest on a fixed-interest security 'the stock carries a 10 per cent ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/interest-rates-1d0e17952d9949b1bab273e830855f90.png)

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)

Post a Comment for "45 coupon vs interest rate"