42 pricing zero coupon bonds

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero coupon bonds have a duration equal to their time until maturity, unlike bonds which pay coupons. Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular ... Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero coupon bonds are particularly sensitive to interest rates, so they are also sensitive to inflation risks. Inflation both erodes the value of the dollars the bond will eventually pay. In the United States, you need to impute the interest for some zero coupon bonds to pay taxes in the current year (possibly also for state or local taxes). One tax workaround is to purchase zero …

Zero coupon bonds are back in flavour. Will the party continue? 06.09.2022 · In August, NBFCs such as TMF Holdings, Tata Motors Finance, Tata Capital Financial Services and L&T Finance raised an aggregate Rs 1,683 crore via zero coupon bonds maturing in two years to four years

Pricing zero coupon bonds

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Perhaps the most familiar zero-coupon bonds for many investors are the old Series EE savings bonds, which were often given as gifts to small children. These bonds were popular because people could... › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. Invest in G-SEC STRIPS India - Bondsindia.com Let’s understand the pricing better with the help of an example. The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being made at the end of each year. The maturity of the bond is 4 years. If the bond is redeemable at a premium of 11%. What would be the present market price of the bond?

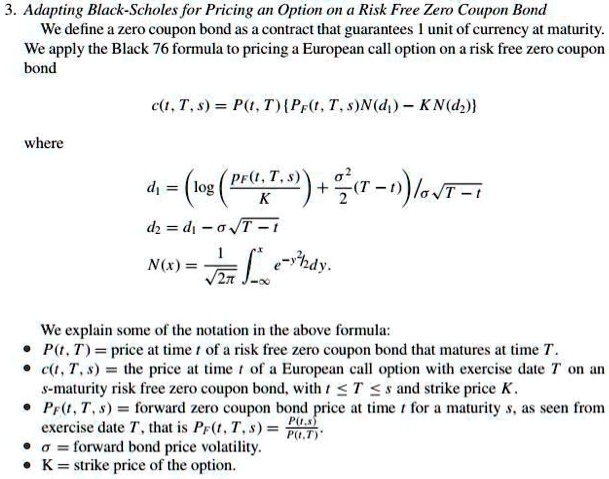

Pricing zero coupon bonds. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. Zero-Coupon Swap Definition - Investopedia A zero-coupon swap is a derivative contract entered into by two parties. One party makes floating payments which changes according to the future publication of the interest rate index (e.g. LIBOR,... The Cash Account and Pricing Zero-Coupon Bonds - Coursera In this module, we're going to discuss the cash account and pricing zero-coupon bonds in the context of the binomial model for the short rate. The cash account and zero-coupon bonds are extremely important securities and derivatives pricing in general and so we're going to spend some time now figuring out how to price them and understand the mechanics of these securities. › gstripsInvest in G-SEC STRIPS India - Bondsindia.com Let’s understand the pricing better with the help of an example. The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being made at the end of each year. The maturity of the bond is 4 years. If the bond is redeemable at a premium of 11%. What would be the present market price of the bond?

Government - Continued Treasury Zero Coupon Spot Rates* Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero Coupon) Rates" on the following website: . Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation. Bootstrapping | How to Construct a Zero Coupon Yield Curve in … Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ... Zero-Coupon Bond - Definition, How It Works, Formula 28.01.2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today …

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ... › bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ... What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity. Example 2. In a second example, assume that imputed interest compounds semiannually. Zero-Coupon Bond: Formula and Calculator [Excel Template] Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

How Premium Bonds are Priced | Zero Coupon Bond | Savings - PFhub Let's consider a zero coupon bond with a par value of $5,000 and a maturity period of 5 years. Let's assume that the required rate of return is 10%. Plugging these values in the bond pricing formula: Price = [$5,000 / (1+.05)^10] = $3069.5 Compare this price with the price of the plain vanilla bond that we calculated in the last example.

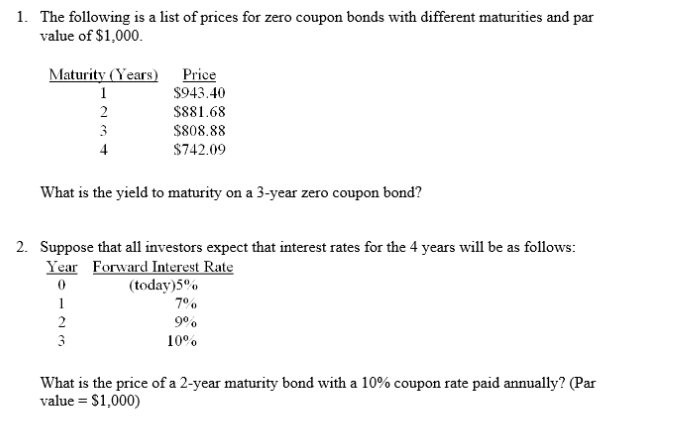

probability - Pricing a Zero-Coupon Bond - Mathematics Stack Exchange Pricing a Zero-Coupon Bond. 1. We have a model in which: There are avaiable 4 zero-coupon bonds, for which maturity date are t = 1,2,3 and 4 respectively. Let P (t,T) means the price of the bond at the moment t expiring at the monet T. Additionally we know that 𝑃 (0,1) = 0.968, 𝑃 (0,2) = 0.912, 𝑃 (0,3) =0.861, 𝑃 (0,4) = 0.778.

Bond: Financial Meaning With Examples and How They Are Priced 01.07.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

corporatefinanceinstitute.com › bond-pricingBond Pricing - Formula, How to Calculate a Bond's Price A zero-coupon bond pays no coupons but will guarantee the principal at maturity. Purchasers of zero-coupon bonds earn interest by the bond being sold at a discount to its par value. A coupon-bearing bond pays coupons each period, and a coupon plus principal at maturity. The price of a bond comprises all these payments discounted at the yield to maturity. Bond Pricing: Yield to Maturity

Understanding Bonds: The Types & Risks of Bond Investments Because bonds tend not to move in tandem with stock investments, they help provide diversification in an investor's portfolio. They also provide investors with a steady income stream, usually at a higher rate than money market investments Footnote 1. Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and …

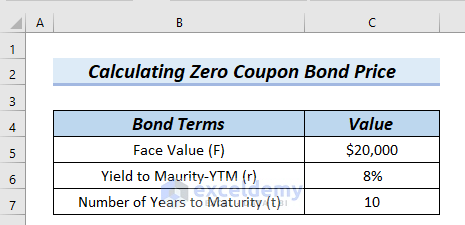

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest that will be earned over the 10-year life of ...

Zero-Coupon Bonds and Taxes - Investopedia Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion....

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity

› news › businessZero coupon bonds are back in flavour. Will the party continue? Sep 06, 2022 · In August, NBFCs such as TMF Holdings, Tata Motors Finance, Tata Capital Financial Services and L&T Finance raised an aggregate Rs 1,683 crore via zero coupon bonds maturing in two years to four years

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Zero Coupon Bond: Formula & Examples - Study.com Purchase a $10,000 Zero Coupon Bond from Company X that matures in 5 years. According to the latest quote, the $10,000 Zero Coupon Bond of Company X is trading at $9,110. You thus have a decision...

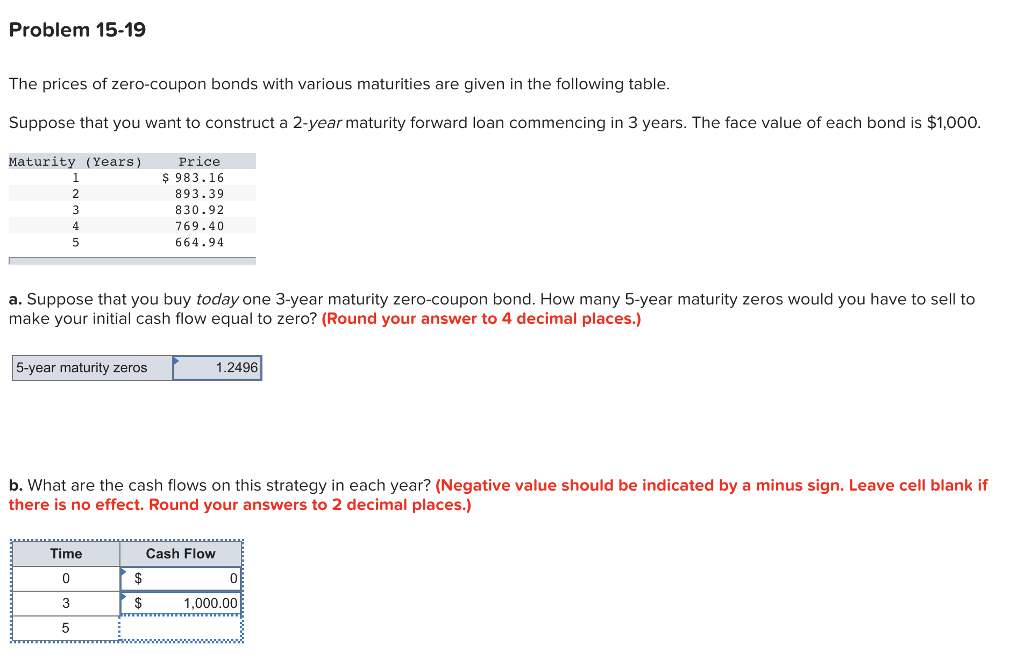

Pricing zero coupon bonds | Python - DataCamp To do this, you are going to price a zero coupon bond with a three year maturity and yield of 5% per year. Then you will change the maturity and yield and see how these factors affect the price. In this exercise, you are going to work directly with the compound interest formula instead of using the npf.pv () function.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Invest in G-SEC STRIPS India - Bondsindia.com Let’s understand the pricing better with the help of an example. The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being made at the end of each year. The maturity of the bond is 4 years. If the bond is redeemable at a premium of 11%. What would be the present market price of the bond?

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Perhaps the most familiar zero-coupon bonds for many investors are the old Series EE savings bonds, which were often given as gifts to small children. These bonds were popular because people could...

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/08135541/Zero-Coupon-Bond-Calculator.jpg)

Post a Comment for "42 pricing zero coupon bonds"